How bonds work

The gist

Bonds work by borrowing money now to pay for new things or big improvements to old things that require big expense, but we'll benefit from over a long time. Sometimes the things we fund will pay back the money borrowed through revenue they generate, such as a new bridge that can bring in tolls, but most of the time we pay back the money borrowed through the regular budget or adding new taxes.

Tell me more

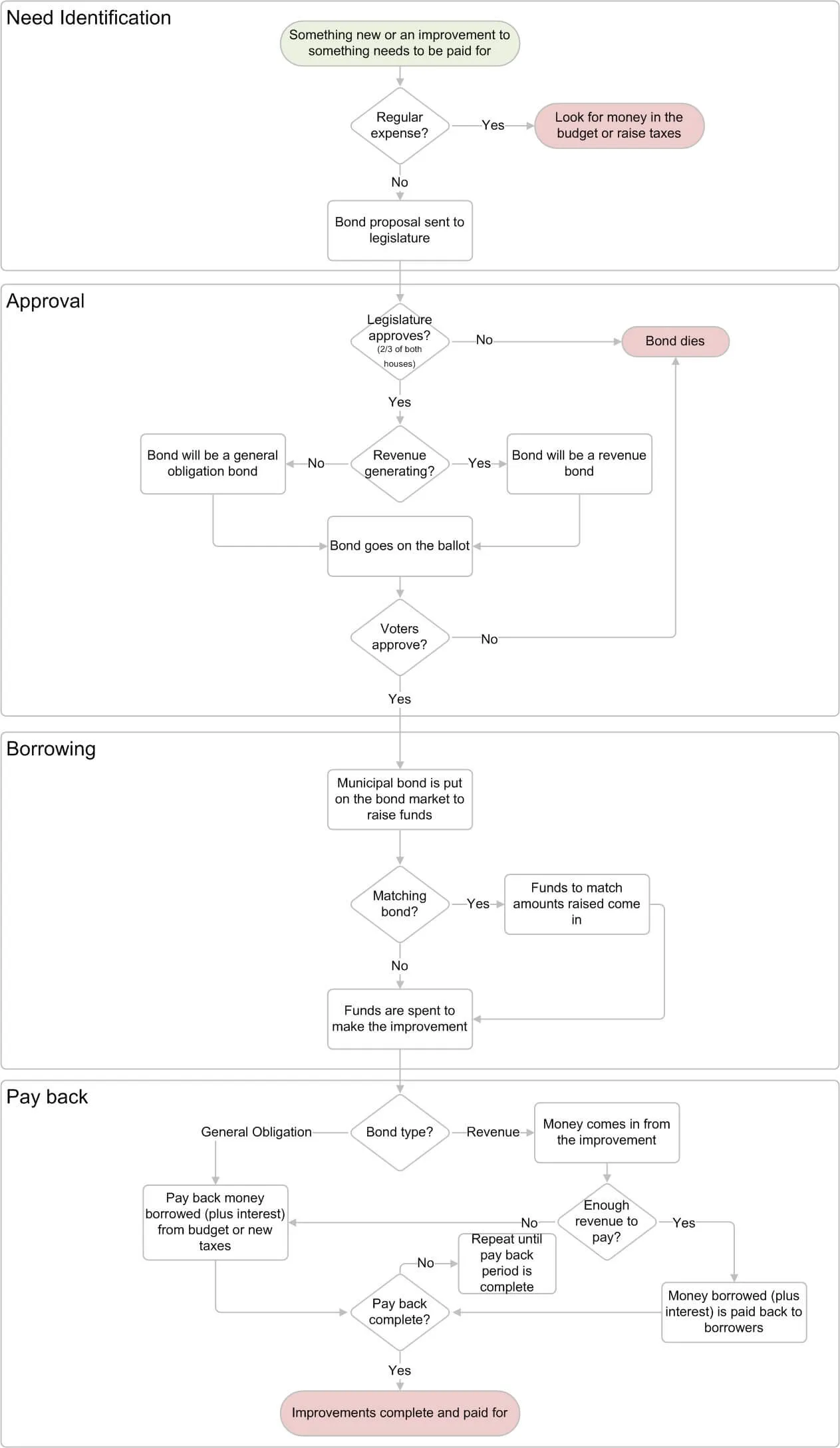

Here is a more detailed look at how the bond process works.

Follow the money

The money will be used to:

- Bonds are used to pay for large, one-time expenses, such as infrastructure improvements.

- Usually, the benefits of the thing we’re paying for last for a long time, so it makes sense to fund the expense over time.

The money will be coming from:

- Initially, the money is borrowed from people who purchase municipal bonds.

- Over the course of the payback period (usually around 10 years), the money comes from either revenue generated by the improvement (i.e. tolls collected from a new bridge) or by finding room in the budget or adding new taxes.

Pros

The primary arguments for bonds are:

- Bonds allow a government to pay for large improvements up front, but spread the cost over the useful life of the thing they’re funding.

Cons

The primary arguments against bonds are:

- If a government entity racks up too much bond debt, it can be difficult to pay them back. There have been cities and towns that have gone bankrupt because they couldn’t pay back their bonds.

Further reading

References

- Dalmas, Jeremy. What exactly are these municipal bonds all over your ballot?. KALW. Accessed October 21, 2018.

- Maine State Treasurer. State Bond Process. Accessed October 21, 2018.

- Ballotpedia State Desk. Bond Issue. Ballotpedia. Accessed October 21, 2018.